Endorphina Club Returns to Host the GamingTECH CEE Awards Ceremony & Party at HIPTHER Prague Summit 2026

Prague, Czech Republic — HIPTHER proudly announces the return of the Endorphina Club Awards Party & Ceremony, the official celebration of the GamingTECH CEE Awards 2026, taking place on 24 March 2026 at 20:00 at the iconic Buddha Bar Prague. Organised by Endorphina, the Awards & Party Sponsor of the HIPTHER Prague Summit 2026, the…

A dialogue between the crypto industry and the government will take place at the VIII Crypto Summit!

Industry leaders, government representatives, and technology companies will take the stage. We will discuss regulation and key trends that will shape the development of the crypto market in the coming years. The VIII Crypto Summit 2026 was one of the key discussion platforms of the year for the crypto and fintech community. The program includes…

Digital Euro Conference 2026: Shaping the Future of DigitalMoney

March 26, 2026 – Digital Euro Conference 2026 The Digital Euro Conference 2026 (DEC26) is happening on March 26, 2026, and promises to be one of the most important gatherings of the year for anyone engaged with digital money innovation. This hybrid event brings together industry leaders, policymakers, central bankers, regulators, fintech innovators, and technology…

BWiGA to award best projects in Kula Belgrade in March

Belgrade Web3 and iGaming Awards will take place on March 25th in the Serbian capital. It’s the top-2 must-attend conference-2026 according iGaming News. Following Porto Montenegro, the next conference is planned for Belgrade on March 25. BWiGA will once again bring together leaders of the web3 and iGaming industries, this time in the most famous…

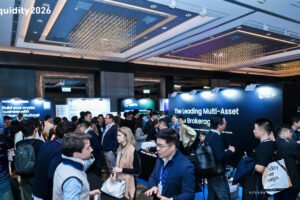

Liquidity 2026: Where Global Institutions Converged on the Future of Digital Assets and TradFi

Summary: From 2023 to 2026, from Hong Kong to a global stage, institutions from around the world convened once again. As the next decade of digital assets unfolds, LTP looks ahead alongside the industry. What does it feel like to observe at close range the front-line pulse of digital assets and traditional finance (TradFi) amid…

UN:BLOCK is Northern Europe’s Largest Blockchain and Fintech Conference

UN:BLOCK is Northern Europe’s Largest Blockchain and Fintech Conference, uniting global innovators, policymakers, and industry leaders to shape the future of blockchain in Europe.After bringing together over 1,200 attendees, 250 companies, and 100+ speakers from 40 countries in 2025, UN:BLOCK 2026 returns to Riga on April 1–2, 2026. The event features inspiring talks, panels, and…

Fintech Week Dubai 2026 Concludes Successfully, Showcasing the Future of Payments, Security & Beyond

16–17 February 2026 | Radisson Blu Hotel, Dubai Deira Creek, Dubai, UAE Dubai, UAE — The 2nd Fintech Week Dubai 2026 successfully concluded on 16–17 February 2026 at the Radisson Blu Hotel, Dubai Deira Creek, bringing together over 50 global leaders, innovators, regulators, and financial experts under the powerful theme “Payments, Security & Beyond.” Organized…

Final Sponsor Recruitment Begins for Japan’s Largest Web3/AI Conference

TEAMZ Inc. (Headquarters: Tokyo, Japan; Representative: Tianyu Yang) is pleased to announce that Title and Gold sponsorship packages for TEAMZ Summit 2026, to be held on April 7–8, 2026, at Happo-en, Tokyo, are now fully sold out. With only one (1) Platinum slot and three (3) Silver slots remaining, TEAMZ has officially entered the final…

Money Expo Mexico 2026 Concludes with Record 7,000+ Attendees, Strengthening Latin America’s Online Trading Landscape

Over 7,000 participants attended the two-day exhibition and conference on Online Trading and digital solutions. Mexico, 19 Feb 2026: The 4th edition of the country’s premier Online Trading & Investment platform, Money Expo Mexico 2026, being held at Centro Banamex, Mexico, concluded with a resounding success with over 7,000 visitors attending the two-day exhibition and…

Digital Assets Week Returns to New York with Deutsche Bank

The world’s leading institutional conference is back in the heart of New York on 13-14 May, where capital markets transformation will be examined in depth, from issuance and market structure to settlement, custody, liquidity and regulatory alignment. This year’s event will be hosted by Deutsche Bank with the underlying foundation of Global Asset Digitization projects….