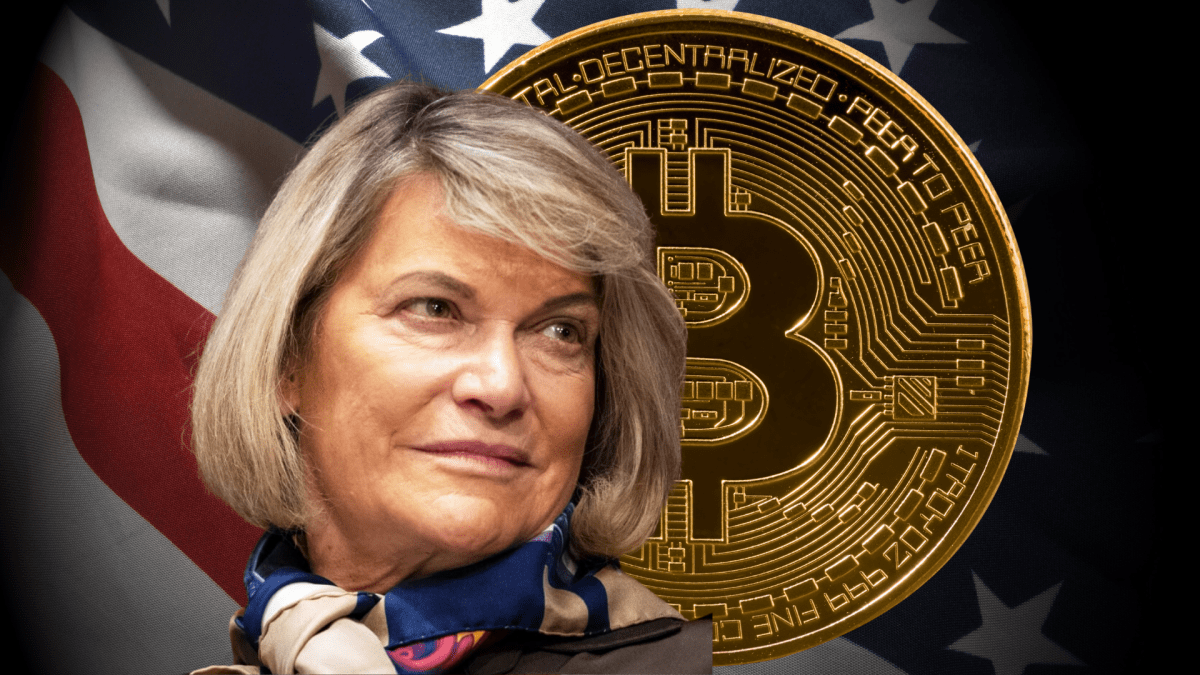

Fed’s ‘Skinny’ Accounts End Operation Chokepoint 2.0 — Senator Lummis

In a major development stirring debate across crypto news circles, Wyoming Senator Cynthia Lummis believes the Federal Reserve’s proposal to introduce “skinny” master accounts for crypto firms could end what the industry calls Operation Chokepoint 2.0, a pattern of financial discrimination against blockchain-based companies.

The initiative, introduced by Federal Reserve Governor Christopher Waller, could represent a turning point in U.S. crypto policy, opening a pathway for digital asset companies and fintech startups to access Federal Reserve accounts previously limited to traditional banks.

Waller’s Plan for “Skinny” Accounts

Governor Waller outlined his vision at the Payments Innovation Conference in October, recommending limited-access Federal Reserve accounts for non-traditional financial institutions, including payment-focused banks and crypto companies. Known as “skinny master accounts,” these accounts would allow firms to process payments through the Fed with certain restrictions, improving liquidity and transparency.

Reacting to the proposal, Senator Lummis said on X (formerly Twitter):

“Governor Waller’s skinny master account framework ends Operation Chokepoint 2.0 and opens the door to real payments innovation. Faster payments, lower costs, better security this is how we build the future responsibly.”

Her statement was celebrated within the crypto pur community, which views the move as validation for blockchain technology’s expanding role in the financial system.

Understanding Operation Chokepoint 2.0

Operation Chokepoint 2.0 refers to an alleged pattern of financial exclusion that saw dozens of crypto founders and blockchain startups lose access to banking services. Venture capitalist Marc Andreessen claimed that more than 30 tech founders were “debanked” without justification under what appeared to be coordinated scrutiny from regulators.

This effort mirrored the original Operation Choke Point, a controversial 2013 U.S. initiative that pressured banks to cut ties with certain industries deemed high-risk. The crypto sector claims that similar tactics have quietly resurfaced in recent years under what it calls a “modernized version” designed to limit blockchain adoption.

Waller’s proposal signals a shift in Washington’s attitude toward blockchain and digital finance. It marks a broader acknowledgment among policymakers that cryptocurrency and blockchain technology are no longer fringe innovations but integral components of the payments ecosystem.

Trump’s Executive Order and Ongoing Challenges

Earlier in August, U.S. President Donald Trump signed an executive order prohibiting banks from “debanking” individuals or businesses without lawful cause. The order directed federal banking agencies including the FDIC to identify and penalize institutions found unjustly restricting access to financial services.

While the executive order was welcomed as a step toward fairer financial treatment for crypto companies, many in the industry argue that the problem has persisted.

In November, Jack Mallers, CEO of Bitcoin payments firm Strike, revealed he had been debanked by JPMorgan without explanation. Mallers shared on X:

“Every time I asked them why, they said the same thing: ‘We aren’t allowed to tell you.’”

This wasn’t an isolated case. JPMorgan also froze bank accounts belonging to stablecoin startups BlindPay and Kontigo, citing concerns about sanctioned jurisdictions. For many crypto pur entrepreneurs, these incidents confirm that Operation Chokepoint 2.0 is far from over.

A Step Toward Fair Banking for the Digital Age

With assets like Bitcoin trading near $87,653 and mainstream attention on DeFi and tokenized assets, access to Federal Reserve accounts could level the playing field for crypto firms competing with legacy financial institutions.

Senator Lummis and other pro-crypto lawmakers see Waller’s “skinny account” proposal as a historic opportunity to integrate blockchain technology into the core of the U.S. financial system. If implemented, it could enhance innovation while restoring banking transparency for crypto companies long marginalized by traditional finance.

As crypto news spreads across markets, many analysts suggest this framework may finally bridge the gap between decentralized finance and institutional banking a move that could transform how blockchain connects to global payment infrastructure.

For now, the message is clear: the era of debanking crypto might be nearing its end, and the promise of an inclusive, innovation-driven banking system is within reach for the crypto pur community.