Bitcoin’s 2025 ‘Bear Market’ Could Precede Decade-Long Rally: Mow

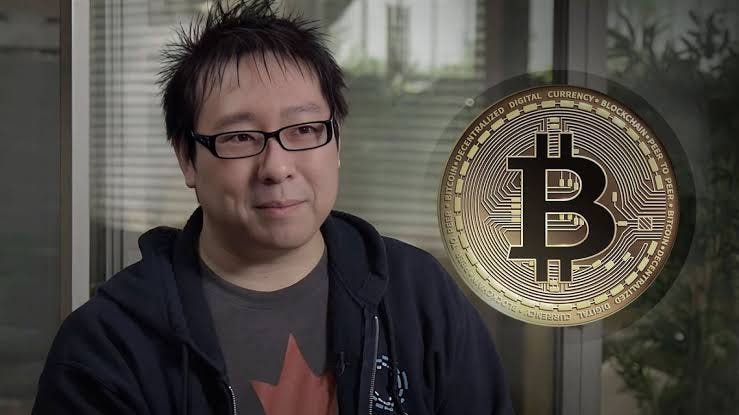

In one of the more surprising takes from recent crypto news, Jan3 founder Samson Mow has described 2025, a year when Bitcoin reached new all-time highs, as a bear market. Despite Bitcoin peaking at over $125,000 in October, Mow believes this period represents a cooling phase before a “decade-long bull run” powered by renewed adoption and confidence in blockchain technology.

His outlook contrasts sharply with that of other analysts who see the same year as a cycle peak, potentially signaling the start of a larger correction in 2026.

Mow: “We’re Resetting Before the Next Major Run”

In a recent X post, Mow said, “2025 was the bear market,” suggesting that price stagnation, emotional fatigue, and missed expectations define a bear cycle even without dramatic collapses. He believes Bitcoin’s sideways action this year has allowed for necessary consolidation before a long-term growth phase fueled by institutional maturity and global adoption of blockchain-based systems.

“The market may have underperformed relative to hype,” Mow added, “but what’s building beneath the surface will push Bitcoin to new heights later in the decade.”

Fellow analyst PlanC agreed with Mow’s take, writing on X, “If you made it through 2025, you made it through the bear market.”

Bitcoin in the Red: Historical Trends Break?

As 2025 comes to a close, Bitcoin is down roughly 9% year-to-date, trading around $87,210, according to CoinMarketCap data. This underperformance has taken many in the crypto pur community by surprise, especially after October’s all-time high of $125,100.

Historically, Bitcoin has never recorded two consecutive red yearly candles meaning two years of annual losses in a row. However, that record could be tested if bearish momentum continues into early 2026.

Earlier forecasts were far more optimistic. Both Arthur Hayes, co-founder of BitMEX, and Tom Lee, chair at BitMine, had predicted prices could reach as high as $250,000 by the end of the year. Instead, the market has ground to a halt under heavy macroeconomic pressure and weakening investor sentiment.

Fear Dominates Sentiment in Late December

Market psychology paints an equally cautious picture. The Crypto Fear & Greed Index fell to 20/100 on December 26, signaling two straight weeks of “extreme fear.” The gauge has remained depressed since mid-December, reflecting investors’ jitters about inflation, interest rates, and tightening liquidity.

While these dips often present buying opportunities, many crypto pur investors remain on the sidelines a classic hallmark of a late-stage bear phase where short-term pessimism masks long-term opportunity.

Experts Split on What’s Next for 2026

The question now dividing analysts is where Bitcoin heads next. Veteran trader Peter Brandt recently warned that Bitcoin could slip to $60,000 by Q3 2026. Similarly, Jurrien Timmer, director of global macro at Fidelity, expects 2026 to be a “rest year,” possibly bringing prices back to the $65,000 range as part of a healthy retracement phase.

On the other side, several strategists argue that the fundamentals remain strong. Phong Le, CEO of Strategy, said Bitcoin’s network growth, mining resilience, and institutional accumulation remain robust despite weaker sentiment.

Bitwise’s Chief Investment Officer Matt Hougan is even more optimistic, predicting that 2026 will mark the beginning of a new upswing, potentially pushing Bitcoin back toward six-figure valuations.

Blockchain Fundamentals Remain Strong

While short-term price action draws headlines in crypto news, underlying blockchain technology continues to evolve. From stablecoin innovation to lightning network growth and institutional custody integration, the ecosystem is far healthier than during earlier market cycles.

Samson Mow echoed this point, arguing that Bitcoin’s next expansion will be supported not just by speculation but by widespread real-world adoption. “The infrastructure built during this consolidation phase,” he said, “will underpin the next major blockchain decade.”

As 2026 approaches, one thing is clear Bitcoin’s story is far from over. Whether this year proves to be a bear trap or the start of something bigger, investors and crypto pur enthusiasts alike are preparing for what could be the beginning of a multi-year rally.