ARK Invest Boosts Coinbase and BitMine Holdings as Crypto Stocks Dip

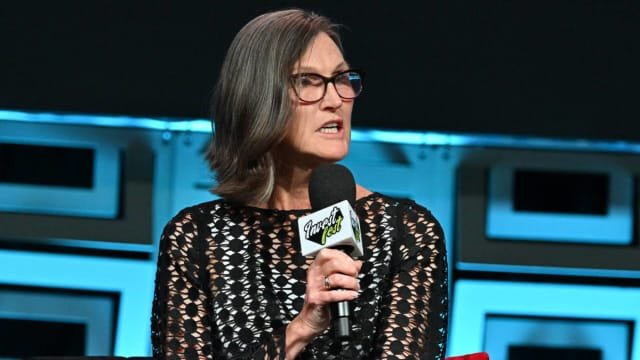

Leading investment manager ARK Invest, under the guidance of Cathie Wood, capitalized on the latest stock market volatility by significantly increasing its positions in top crypto sector equities Coinbase (COIN) and BitMine Immersion Technologies (BMNR). The high-profile buys, totaling $47 million, demonstrate ARK Invest’s continued confidence in the digital asset ecosystem, even as broader market jitters trigger sharp price declines.

ARK Invest Seizes Buying Opportunity in Coinbase Shares

During Friday’s market downturn, ARK Invest added 94,678 shares of Coinbase across its flagship ETFs: ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). The firm’s cumulative spend on COIN shares reached approximately $30 million as the stock fell 16.7% its steepest single-day drop in recent months and closed at $314.69, well below its 52-week high of $444.64. Intraday, COIN touched a low of $310.55, signaling a key entry point for institutional investors seeking exposure to the leading U.S. cryptocurrency exchange.

This aggressive purchase follows a period of strategic selling by ARK, which saw ARKW offload over 18,000 COIN shares just days earlier, banking nearly $7 million at a higher price point. The rapid shift highlights ARK’s active approach to managing volatility and maximizing value in the crypto equities market.

ARK Invest Ramps Up Exposure to BitMine Immersion Technologies

Alongside its Coinbase acquisitions, ARK Invest also snapped up 540,712 shares of BitMine Immersion Technologies, amounting to roughly $17 million. Despite BMNR’s 8.55% decline to $31.68 per share during Friday’s choppy session, ARK’s thematic funds ARKK, ARKW, and ARKF all participated in the buy. This flurry of buying tops off a busy period for ARK Invest, which poured more than $20 million into BMNR shares earlier in the week, following a large $182 million purchase the previous week.

BitMine is fast becoming a crypto industry standout thanks to its bold pivot into Ether (ETH) accumulation. Strategic Ether Reserves data positions BitMine as the largest Ether treasury holder among public companies, with a reported 625,000 ETH outpacing rivals like SharpLink Gaming.

Market Context: Wall Street Retreats on Weak Jobs Data

The timing of ARK’s buys coincided with a broader sell-off on Wall Street. U.S. stocks opened August on a sour note after fresh data revealed a sharp slowdown in job creation just 73,000 new positions in July, below expectations. Revised May and June data showed even weaker growth, signaling persistent cracks in the labor market. Industrial giants like GE Aerospace and Caterpillar also posted losses as broader economic uncertainty weighed on sector sentiment.

Bank stocks led Friday’s declines as JPMorgan, Bank of America, and Wells Fargo each fell over 2–3%, reflecting investor concerns over a cooling economy and diminished loan demand in the face of newly adjusted tariff policies and mixed signals from the Trump administration.

ARK Invest’s Crypto Strategy: Buying the Dip

Despite volatile macro conditions and sector-wide pullbacks, ARK Invest’s strategy remains clear: leverage market dips to accumulate high-conviction crypto assets. The firm’s continued support for Coinbase and BitMine underscores its belief in the long-term potential of blockchain technology and its leading players.

ARK’s diversified approach with stakes in key exchanges and mining firms positions its funds to benefit from the expanding adoption of cryptocurrencies in both trading and treasury management. As institutional interest in Ether and Bitcoin deepens, and as regulatory clarity grows around crypto finance, ARK Invest’s moves signal a bullish stance for those seeking to align traditional portfolios with the future of digital assets.

With market volatility often presenting opportunities for patient investors, ARK’s latest moves reinforce a core investment principle: long-term success favors those willing to act when others hesitate in the face of short-term uncertainty.