Trump’s Crypto Working Group Pushes for Regulatory Clarity as Digital Asset Adoption Accelerates

The White House’s focus on digital finance is intensifying, with President Donald Trump’s crypto working group urging federal agencies to deliver clearer rules for cryptocurrency trading and streamline innovation in the rapidly evolving blockchain economy. This regulatory push comes as three major U.S. crypto bills targeting stablecoins, market structure, and central bank digital currencies (CBDCs) gain traction in Congress, signaling a pivotal moment for the nation’s digital asset industry.

White House Digital Asset Task Force Seeks Action on Crypto Rules

Established by executive order in January, the White House Working Group on Digital Asset Markets led by tech investor David Sacks recently put forward policy recommendations designed to strengthen the U.S. as a leader in blockchain technology and tokenized finance. Among the group’s core proposals:

- Immediate Regulatory Clarity: The group called on the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) to quickly clarify federal guidelines for digital asset custody, trading, registration, and record-keeping. The aim is to facilitate legal trading and reduce confusion for both companies and investors.

- Elimination of Bureaucratic Delays: By streamlining regulatory approval processes, the group hopes to accelerate the rollout of innovative financial products, reducing waiting times and improving consumer access.

- Pro-crypto Tax Policy: The working group urges Congress to officially recognize cryptocurrencies as a unique asset class and to adapt existing securities or commodities tax rules, making compliance more straightforward for individuals and businesses.

While not directly drafting legislation, the task force’s influence is evident in the content and direction of key bills moving through Congress, including regulatory frameworks for stablecoins, digital asset oversight, and new rules for tokenized market products.

Major Crypto Legislation Advances in Congress

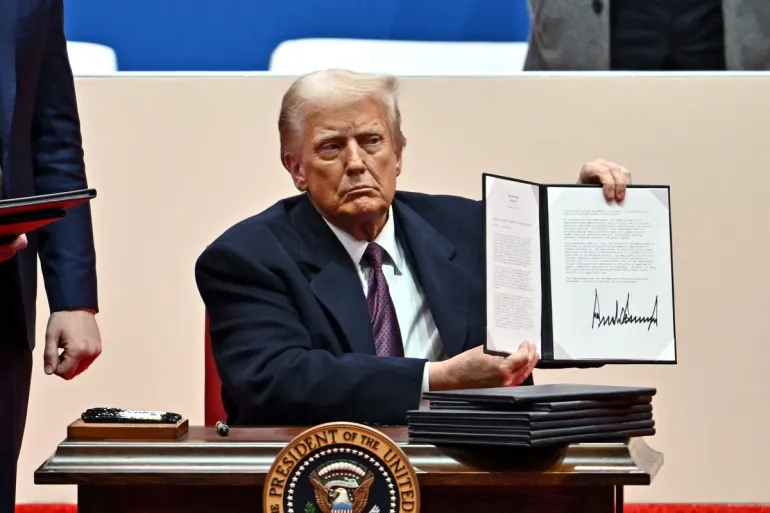

This month, President Trump signed the GENIUS Act into law, establishing a regulator-friendly framework for stablecoins and digital dollar integration. Additionally, the CLARITY Act and the Anti-CBDC Surveillance State Act have passed the House and will be reviewed in the Senate after the August recess. Together, these laws:

- Establish rules for stablecoin issuance and management.

- Clarify the structure of digital asset markets and compliance procedures.

- Impose restrictions on centralized digital currencies to safeguard financial privacy.

Positive Reception from Crypto Industry and Wall Street

Industry observers and analysts are optimistic that clear federal regulations will fuel mainstream adoption of digital assets and innovative blockchain products. According to the Atlantic Council, the wave of regulatory clarity is prompting leading U.S. financial institutions including JPMorgan, Citigroup, and Bank of America to signal their intent to offer stablecoins and tokenized investment products to retail customers.

“For Americans, this means your bank may soon be offering you stablecoins and possibly even tokenized ways to invest in the stock market,” the Atlantic Council observed.

Major legislative changes are also expected to advance real-world asset tokenization in the U.S. By lowering regulatory barriers and easing digital onramps, the GENIUS Act stands to accelerate both institutional and mainstream participation.

Michael Sonnenshein, president of Securitize and former Grayscale CEO, emphasized the Act’s positive impact for hesitant asset issuers: “For any of the asset issuers that have perhaps been on the sidelines… this now offers them a little bit of additional air cover.”

The Road Ahead for U.S. Crypto Regulation

With bipartisan momentum growing in Washington, digital assets are poised for deeper integration into traditional finance. As the White House’s crypto working group and Congress work to clarify crypto trading, tax, and custody rules, Americans can expect more banks and fintech companies to roll out new crypto products, tokenized assets, and stablecoin services.

These regulatory developments mark a significant step forward in making the U.S. a global hub for digital asset innovation, with both the private sector and government working in tandem to shape the future of finance.